Only losers average losers

Product Management lessons from one of the best stock market traders.

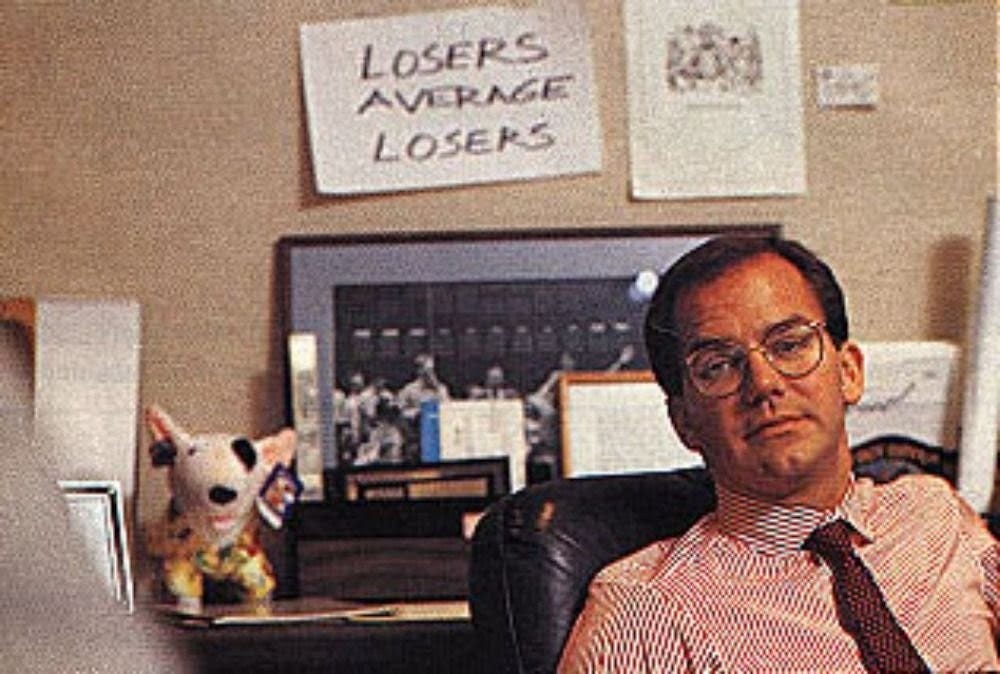

I've been investing in the stock market for more than a decade, and I recognize that it is a world that I am equally passionate about and entertained. I follow several accounts related to the sector on Twitter, and this week I saw an image in one of them that caught my attention.

The image is from Paul Tudor Jones, a billionaire American investor. One of his most remarkable achievements was anticipating the October 1987 Black Monday. But we are not here to analyze Jones' investments. What struck me was the photo phrase seen in the background "Losers average losers".

It caught my attention because it hooked on a topic that I'd wanted to write about for a long time — the peril of sunk costs and how to avoid falling prey to them while creating products.

The sunk cost trap

A sunk cost in economics is one that you have incurred and can no longer recover. From a rational point of view, that cost is lost and should not influence any future decision-making. However, time and time again, humans demonstrate that we are not particularly rational.

A practical example of sunk cost in our daily lives could be trying to finish a bad book for the simple fact that we have already started it. The rational decision would be to abandon it as soon as we stop enjoying it. The reality is that the simple fact of having invested some time can prevent us from doing so.

The result is terrible indeed. In the best case, we will spend more time doing something that will not give us anything back. At worst, we will postpone reading other books that we may enjoy.

Another example of sunk cost mismanagement in the real world is relationships. Rationally, the decision to end a relationship that is no longer going anywhere should not consider the years we have spent in it. There is nothing we can do to get them back. Despite this, we tend to remain tied to people who harm us simply by not accepting the loss.

Sunk costs are not limited to the personal sphere. Companies and governments around the globe are prone to falling for them. We have a curious example in the world of venture capital and funds that invest in startups. Rationally, if a fund invests in a company and doesn't go as expected, it should cut the loss and move on.

However, on many occasions, we observe how before accepting that cost, professional investors try by all means to recover the invested capital, even if that means burning even more money. A recent example was Softbank's failed investment in WeWork.

Being a professional does not save you from falling into the trap of sunk costs.

Only losers average losers

I go back to Paul Tudor Jones and his phrase "Losers average losers". In the investing world, there is a technique called averaging down. It consists of lowering the average price paid per share, buying more when it falls, looking for an earlier recovery. Let's look at an example.

Let's say we buy 100 shares of any company at $10 each, with such bad luck that it drops to $5 in the following weeks. At this point, we could assume that our bet has gone wrong, accept the loss by selling, and dedicate that money to more fruitful investments. However, many investors choose to average lower, trying to lessen the loss and accelerate the recovery.

They do it by buying 100 more shares at the new $5 price. In this way, they have 200 shares for which they have paid $1500, "lowering" the price paid per share to $7.5. In this way, the stock only has to go up 50% to recoup their investment.

Look at the absurdity. Nobody buys stocks because they think they are going to go down. We buy stocks that we think may go up. However, the market tells us very explicitly that we were wrong. Instead of accepting it, admitting defeat, and investing in more productive places, we end up spending more money, expecting to recover sooner.

Only losers average losers.

How to avoid falling into the sunk cost trap

If you've made it this far, you probably already have some examples in your head of situations in which you or your company has fallen into a sunk cost.

The by-the-book example is that product or functionality that took months to develop, which has not produced the expected results but continues to absorb resources simply because sunsetting it would be accepting our failure.

It's natural. The human mind is stubborn. Even knowing the sunk cost trap won't allow you to escape it easily. Being this the case, we must be especially cautious when developing a product to avoid falling head over heels for it.

Here are some techniques that could be useful to avoid it.

Develop small

If you have to invest months of work in launching an initiative, when you finally do it, you will be so sunk in it that it won't be easy to abandon. Officially you will have linked your future to that of the initiative. If it fails, you will fail, so you will tend to dedicate whatever resources are needed to refloat it even if it no longer makes sense.

The correct approach is to develop small. Imagine that your goal for the quarter is to increase the acquisition by 10%. You can invest two and a half months working on an initiative and risk playing it all or nothing 15 days before the end of the quarter. Or you can decide to do five smaller two weeks initiatives with the objective of increasing the acquisition by 2% with each one of them.

Size your bets small. It will make it easier to leave the hand.

Define success before you start

Before starting any initiative, you should have clearly defined what you intend to achieve with it. If you don't, once you launch it, it will be tough to assess whether you have to continue betting on or kill it.

I've seen organizations investing months of work on ideas without making an effort to define precisely what they expect from them. By the time they want to do it, they are already so caught up in the trap that turning back is very difficult.

We seek to facilitate our future decisions. Suppose we have defined success, but we only achieve 10% of what we anticipated. In that case, we will have a powerful tool to decide whether to divest and allocate its resources to other more profitable ones.

The real value of a Product Manager is in making these types of decisions.

Use time to your advantage

Another appealing technique for avoiding being a victim of the sunk cost trap is to use the time to our advantage by limiting the amount we will dedicate to a specific initiative.

In the markets, it is usual to use "Stop Losses", a tool that allows investors to sell a stock when its price goes below a specific price threshold. For example, we can buy a share at $10 and put a stop loss at $8. If the price falls to that level, our broker sells the shares automatically, limiting our loss.

In addition to this technique, Paul Tudor Jones also used the concept of "Time Stop". If an investment did not follow the direction he expected in a specific time, he would sell his position and get out of it.

In the world of product development, Basecamp does something similar. Their development cycles are limited to six weeks. If a team does not get to ship anything significant in those six weeks, they close the initiative and move on to something else. This way, they limit the maximum loss they can suffer from a specific effort to those six weeks.

Do the same by setting the maximum time you will dedicate to an initiative before starting it.

Conclusion

As we've discussed, it's improbable that you can escape the sunk cost trap. The best advice I can give you is to lean on techniques like the ones we have mentioned to avoid falling prey to it.

It is essential to do so because resources are limited. If we are not quick to recover them when we don't get the return that we expect, it will threaten our ability to deliver real value and even our survival as a company.

It is almost a matter of life and death. Your goal is to stay in the game. To do this, we need to be radical by cutting our losses to maximize our number of tries.

Avoid gambling everything on just one hand.